- Creator Crunch ⚡️

- Posts

- ⚡ Tax Bandits & Tax Rates

⚡ Tax Bandits & Tax Rates

Saddle up, we're taking you for a ride in the Wild Wild World Of Creator Tax rates, Bands and Self-assessments

Can you believe it’s our 4th Issue already?

Yes it’s been 8 weeks since we first launched and your feedback so far has been incredible, and we’re always down to hear from you, so do not hesitate to respond to these mails with any thoughts, or questions you have. Our community team is always on hand to support!

Now for those who are new... well

Good day to you & welcome to Creator Crunch

Your personal guide through the wild wild world of Creators 🌎..

Over the last 8 weeks, we’ve spoken on the importance of compliance and why it’s so necessary as a creator to have your finances in order... Most specifically your taxes, but we’re well aware that for some, this is still a huge grey area, specifically when it comes to what is taxable as a ‘Creator’.

First of all, there is no specific tax on ‘Influencers or Creators’, but what we’re talking about is paying taxes on the income you earn from having that presence online.

First of all, if you are a creator, you need to register as Self- Employed with HMRC. You might be wandering if you still have to if you only make content part time, and in short— the answer is Yes.

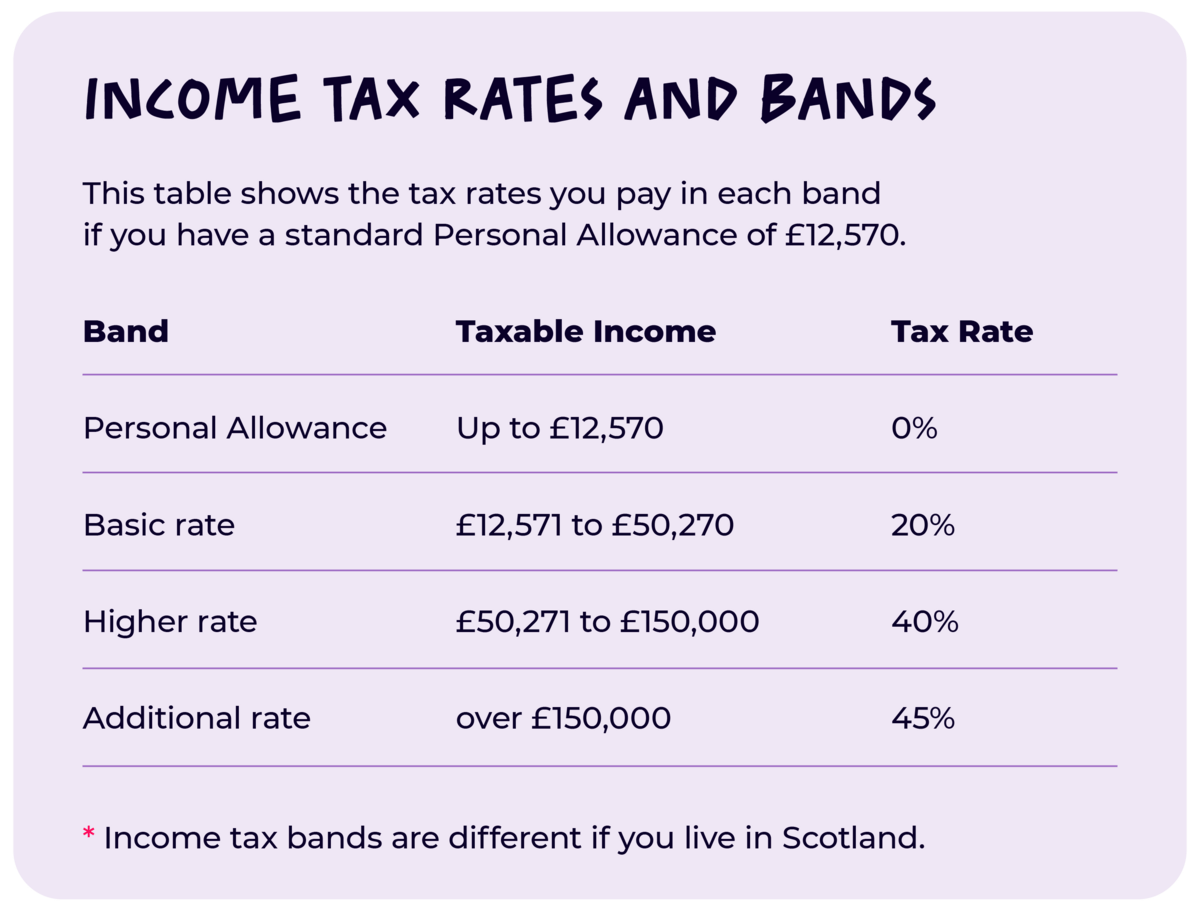

Both part & full time creators will have to do a self-assessment. And the amount that is taxable will depend on the band of earning you are on. Here’s a handy table to break down the current Tax rates

The great thing is that you can offset your income by keeping track of your daily expenses, and filing those at the end of the Tax rate.

So let’s say this year you worked with 10 brands and you made £2000 from each campaign, then your yearly earning is £20,000 before expenses.

Now let’s say you spent £8000 through out the year on things like travel, Camera equipment, Website expenditures or even marketing... then your income after expenses will be £12,000. Which means you actually have 0% to pay back in taxes, as you fall underneath the threshold of your personal allowance.

The important thing to remember is that you will still be required to declare your income, and expenditure, whether you fall way underneath the threshold. Now we know Brands pay big bucks, and to keep it a buck with you...

If you don’t keep track of your documentation, your income and your spending, then you can rack up a bill quickly, and we never want you to play catch up.

Just to note this is what XPO Pro helps you do loool.

So if you’re reading this and you’re not at minimum HMRC registered, I suggest you put this at the top of your priority list for this week!

...and that's the crunch for today.Get serious Rich Kids!

J.H

How confident do you feel about tax rates and income bands after reading this?

Click here to answer our quick Poll